Description

Description

Description

Description

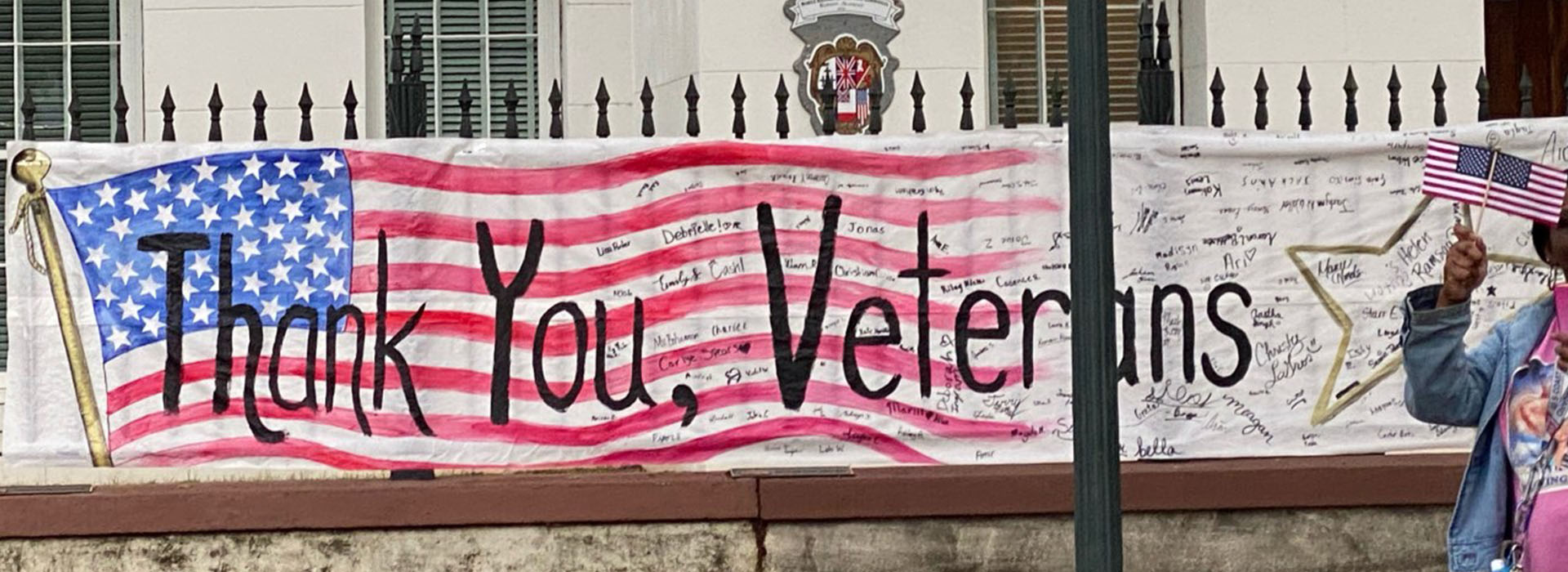

The Alabama State Veterans Memorial Cemetery is located in Spanish Fort.

READ MORE